12 Types of Technical Indicators Used by Stock Traders

If you’re planning to hold a portfolio of blue chip stocks well into retirement, then short-term movements in the market are not likely your biggest worry.

However, if you dabble in the stock market on a day-to-day basis, or if you simply want to know what drives the thinking of other market participants, it can be very beneficial to understand the basics of technical indicators.

Many traders swear by them to help with the timing of their trades or to alert them of trends. But, even for an investor more focused on the underlying fundamentals of companies, learning how these indicators work can provide added conviction on new or existing trades.

Types of Technical Indicators

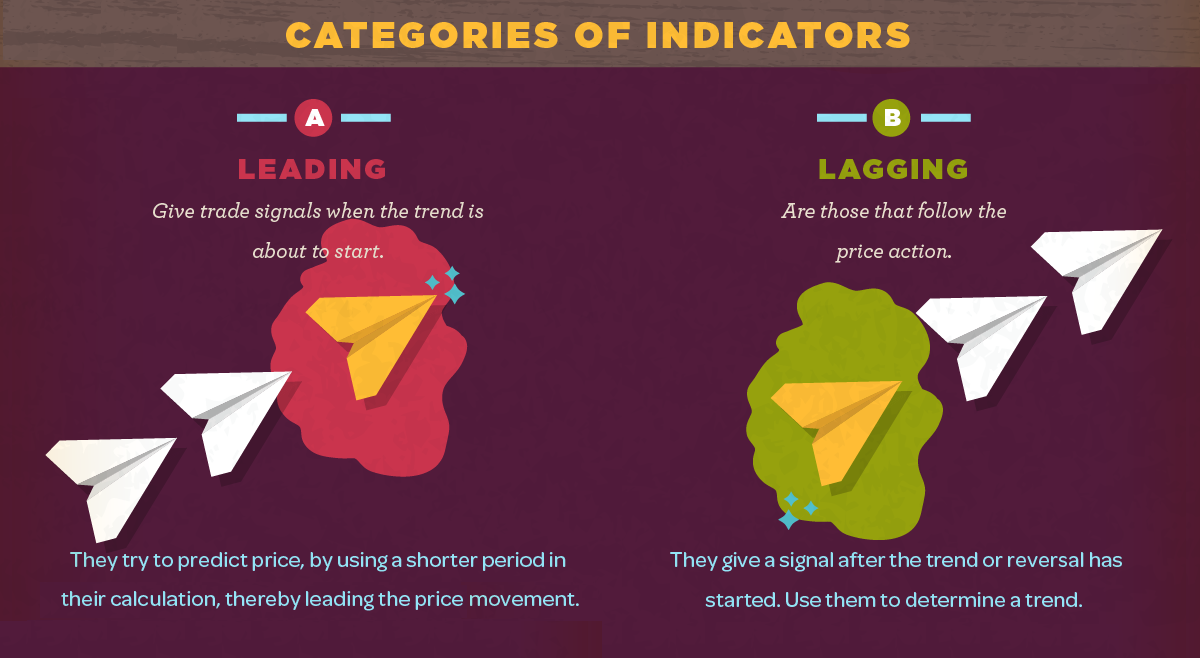

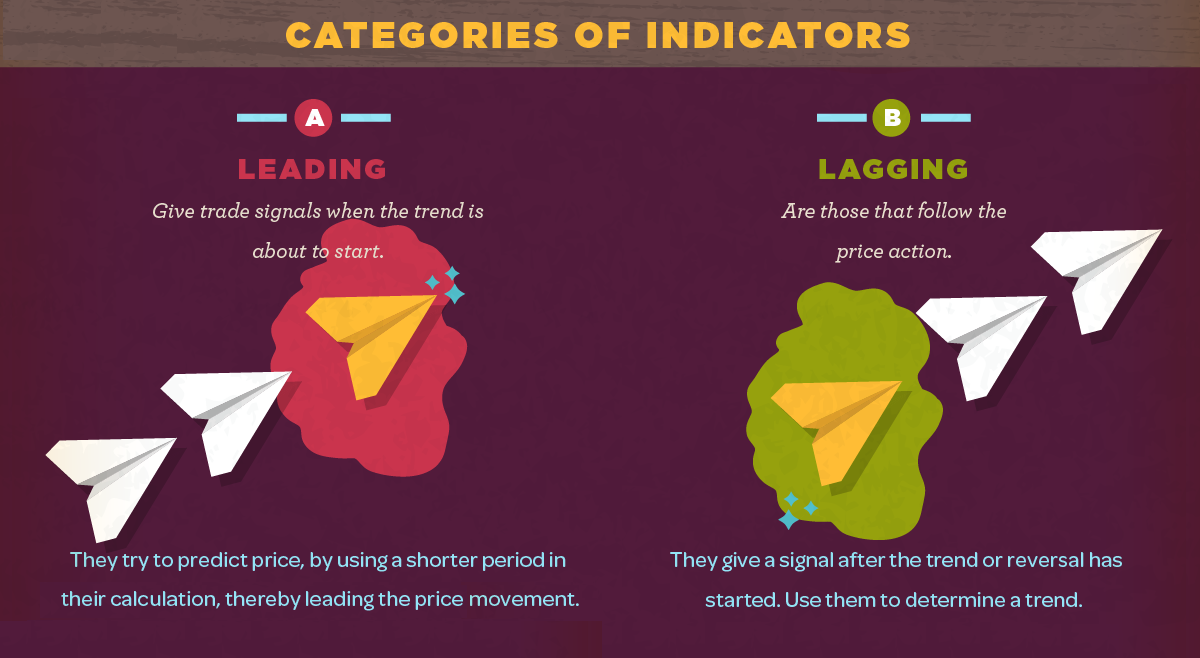

Today’s infographic comes to us from StocksToTrade.com, and it explores the fundamentals behind 12 of the most commonly-used technical indicators. It differentiates between lagging and leading indicators, and also explains some basic tactics for incorporating these markers into an overall investment strategy.

The infographic differentiates between four different types, including trend, momentum, volatility, and volume indicators.

Trend indicators

These technical indicators measure the direction and strength of a trend by comparing prices to an established baseline.

Moving Averages: Used to identify trends and reversals, as well as to set up support and resistance levels.

Parabolic Stop and Reverse (Parabolic SAR): Used to find potential reversals in the market price direction.

Moving Average Convergence Divergence (MACD): Used to reveal changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

Momentum indicators

These technical indicators may identify the speed of price movement by comparing the current closing price to previous closes.

Stochastic Oscillator: Used to predict price turning points by comparing the closing price to its price range.

Commodity Channel Index (CCI): An oscillator that helps identify price reversals, price extremes, and trend strength.

Relative Strength Index (RSI): Measures recent trading strength, velocity of change in the trend, and magnitude of the move.

Volatility Indicators

These technical indicators measure the rate of price movement, regardless of direction.

Bollinger bands: Measures the “highness” or “lowness” of price, relative to previous trades.

Average True Range: Shows the degree of price volatility.

Standard Deviation: Used to measure expected risk and to determine the significance of certain price movements.

Volume Indicators

These technical indicators measure the strength of a trend based on volume of shares traded.