How Macro Trends Shape the Market’s Future

It’s hard to say for certain what the future holds.

Without the luxury of a crystal ball, investors must find opportunities by analyzing the market. There’s just one problem: the 24/7 news cycle is enough to make anyone’s head spin.

Where should an investor focus their attention, when almost every new venture is forecast to be the next big thing?

The Powerful Influence of Macro Trends

Today’s infographic comes to us from U.S. Global Investors, and it highlights how analyzing macro trends can serve as a key investment tool.

Two Main Investment Approaches

When selecting stocks, many investors fall into one of two camps:

1. Top-down Investing

-

- Analyze macroeconomic trends.

-

- Identify specific sectors and regions.

-

- Choose individual stocks based on company fundamentals.

Considering the aging Chinese population, a top-down investor may choose to invest in Chinese healthcare stocks.

2. Bottom-up Investing

-

- Complete in-depth company analyses.

-

- Select a stock that is outperforming others in its sector.

A bottom-up investor could analyze Home Depot and choose to invest if it had strong performance relative to Lowe’s.

These approaches can be used separately, or even combined together. Zooming out allows investors to identify the big picture opportunities. Then, a bottom-up approach can find the companies that best capitalize on each trend.

What is a Macro Trend?

A macro trend is a long-term directional shift that affects a large population, often on a global scale. For example, climate change is affecting industries in both positive and negative ways. While “green” industries have seen increased support, ski resorts are projected to have 50% shorter winter seasons by 2050.

There are a couple of main ways to identify macro trends:

-

- Government policy

Government policies are a precursor to change, shaping macro trends and creating opportunities. For instance, Obama’s Recovery Act fueled growth in renewable energy with a $90 billion investment.

- Government policy

-

- Economic cycles

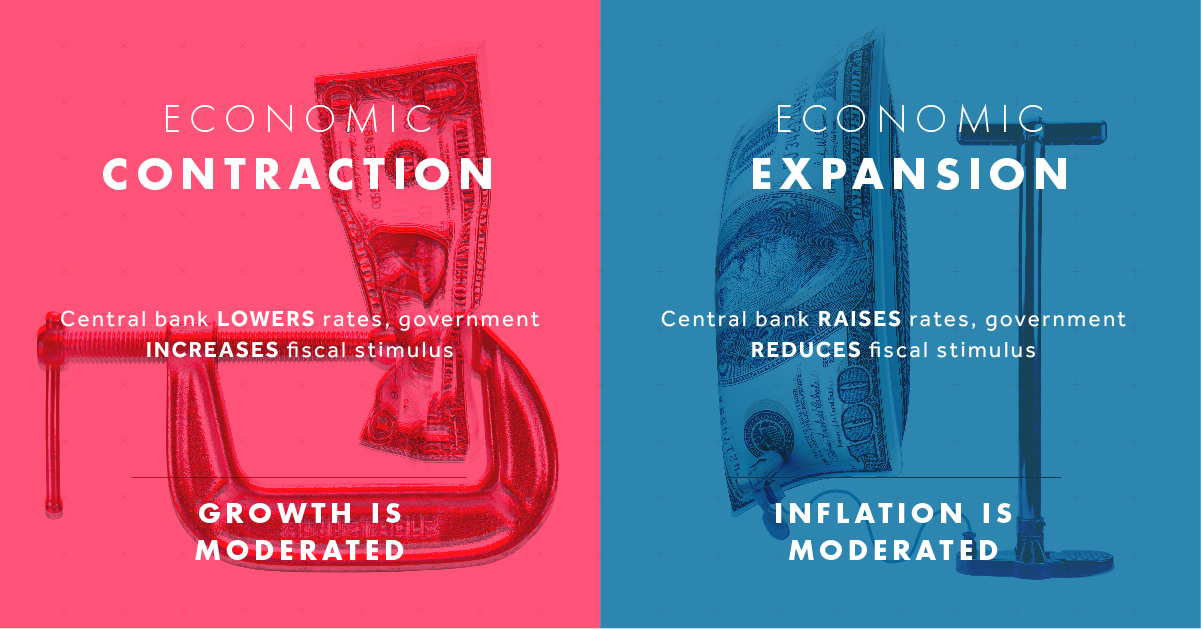

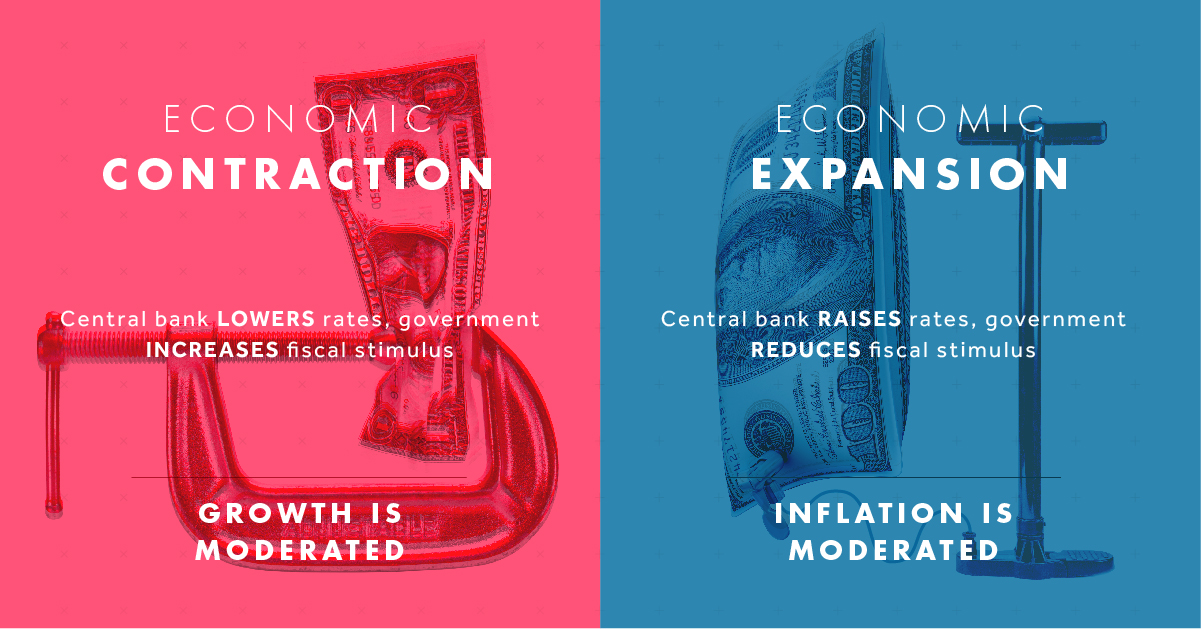

The cyclical nature of the economy means that investors can also use history to identify macro trends. Consider fiscal and monetary policy, which is implemented in response to economic data:-

- Expanding economy

The central bank raises rates and the government reduces fiscal stimulus. As a result, inflation is moderated.

- Expanding economy

-

-

- Contracting economy

The central bank lowers rates and the government increases fiscal stimulus. As a result, growth is stimulated.

- Contracting economy

-

-

- Economic cycles

Discovering Long-Term Value

Macro trends are a key tool for discovering long-term market opportunities. They are beneficial because they are:

-

- Unbiased and data-driven

-

- Not swayed by daily headlines

-

- Tend to avoid riskier, niche industries

-

- Can be diversified by sectors and regions

There are currently many macro trends at play. For example, Trump’s sweeping tax reform and deregulation boosted the U.S. economy, lifting GDP growth to a 13-year high of over 3% in 2018 Q3.

However, not everyone’s a winner. America’s reduced taxes have made Canada less competitive. It’s estimated that 4.9% of Canada’s GDP is at risk due to ripple effects from U.S. tax reform. What’s more, regulators worry that the bank deregulations might put the financial system at risk.

The proposals under consideration… weaken the buffers that are core to the resilience of our system.— Lael Brainard, Member of the Board of Governors of the Federal Reserve

So, how do investors distill this wealth of information into a future of wealth?

Spotting the Next Wave

In today’s hyper-connected world, it’s easy to get lost in data overload. Thinking big picture allows investors to focus on trends that:

-

- Have a long-term outlook

-

- Affect a large population

-

- Create a clearer vision of the future

Then, an investor can target the most promising regions and sectors. When used effectively, this approach enables investors to ride the next big wave that will shape markets.